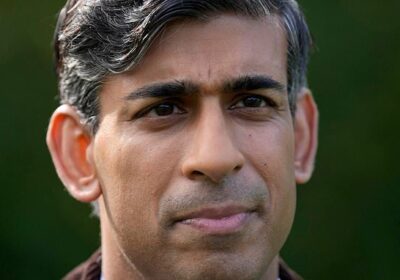

Rishi Sunak revives proposal to SLASH inheritance tax

Rishi Sunak revives proposal to SLASH inheritance tax: PM set to target UK’s ‘most hated’ levy in ‘aspirational offer to voters’ ahead of general election

- Inheritance tax is charged at 40 per cent for estates worth more than £325,000

- £175,000 allowance goes towards a main residence if it is passed to children

Rishi Sunak is planning to revive his proposal to slash inheritance tax.

The Prime Minister is set to target ‘the most hated’ levy in ‘an aspirational offer to voters’ ahead of the next general election.

Cutting the tax before eventually scrapping it is one of many possible crowd-pleasing announcements tax payers could expect to hear before next month’s Conservative Party conference, according to The Sunday Times.

Inheritance tax is currently charged at 40 per cent for estates worth more than £325,000.

An extra £175,000 allowance goes towards a main residence if it is passed to children or grandchildren and a married couple can share their allowance – parents can pass on £1 million to their children without any tax being paid.

The Prime Minister is set to target ‘the most hated’ levy in ‘an aspirational offer to voters’ ahead of the next general election

More than 50 Tory MPs, including former Chancellor Nadhim Zahawi urged Rishi Sunak and Jeremy Hunt to scrap the tax

It is believed that a live discussion was held at the highest level of government about reforming inheritance tax.

One possible announcement is that Sunak will phase out the levy by reducing the 40 per cent rate in the budget while setting out a pathway to scrap it completely in future years.

This comes after comments were made last week by Jeremy Hunt, the chancellor, that there would be no tax cuts when he presents his latest plan at the end of November.

This could make inheritance tax an election issue as voters could ask Sir Keir Starmer if he would be prepared to make the same cuts in future years.

READ MORE: Storm brewing over suggestions Rishi Sunak could scrap inheritance tax in pre-election offer to voters, as Red Wall Tory MPs call for Government to focus on cutting income tax instead

A senior government source told The Sunday Times: ‘No 10 political advisers have been looking at abolishing inheritance tax as something that might go in the manifesto. It’s not something we can afford to do yet.’

‘This is the most hated tax in Britain, according to the polls,’ the source said. ‘It’s the most hated tax at every income. A lot of people don’t know that they won’t pay it.’

This decision comes after the Prime Minister was heavily urged to scrap the levy entirely.

More than 50 Tory MPs, including former Chancellor Nadhim Zahawi urged Rishi Sunak and Jeremy Hunt to scrap the tax.

Mr Rees-Mogg also called for the tax to be scrapped, saying: ‘Death duties are an inefficient form of taxation that is unfair and economically damaging.

‘Unfair because it is a double tax on already taxed assets. Economically damaging because it leads to the misallocation of capital, as investments are made to avoid a distortive tax rather than to maximise investment return.’

Former Home Secretary Miss Patel added: ‘People should be in control of their income and have the ability to determine the future of the assets they have worked hard to save and build up during their lifetime.

‘Substantial long-term reform is required and I would encourage proactive steps to support hard-pressed families across our country.’

The most recent Treasury figures show that 3.76 per cent of UK deaths result in an inheritance tax charge.

The government is also working up plans to:

• Invest up to £1 billion in towns across the country.

• Abolish the northern leg of the HS2 high speed rail link between Birmingham and Manchester as early as this week.

• Reform A-levels, with a British baccalaureate that sees every pupil study English and maths to the age of 18.

• Phase out smoking in open areas such as pub beer gardens and restaurant terraces.

• Crack down on ‘low-grade’ degrees offered by universities.

Source: Read Full Article